Investment Philosophy

Each client’s investment plan is personalized based on the particulars of a family’s situation, risk profile and time horizon.

Goal-based Investing

There is not one solution to how money should be invested. Each client’s investment plan is personalized based on the particulars of a family’s situation, risk profile and time horizon. This includes an in-depth understanding of each client's willingness, ability, and need to take risk with their investments.

We believe that thinking and acting for the long-term is paramount to successful investing and this lies at the center of how we manage client portfolios. With a constant focus on risk management, we are always looking to balance shorter-term fears with longer-term needs and objectives, so that our clients can remain comfortably committed to their plan.

Strategic Asset Allocation

The key to successful investing is the long-term mix of assets. At Patrimonio, we choose to place asset allocation as the centerpiece of our investment philosophy. Asset allocation refers to how an investor allocates their investment across different asset classes — mainly cash, fixed income, and equities.

We believe that a sound investment strategy starts with an asset allocation suitable to the investor’s financial goals and investment objectives. This allocation should be built upon reasonable expectations for risk and returns and should use diversified investments to avoid exposure to unnecessary risks.

Research-driven, evidence-based investing

Our investment philosophy is based on rigorous academic and financial research into market behavior and the sources of returns. We don’t make forecasts or attempt to predict market movements. We believe that recommendations based on historical, observable market behaviors and prices takes emotion out of the equation – and leads to steadier, more predictable results over the long term.

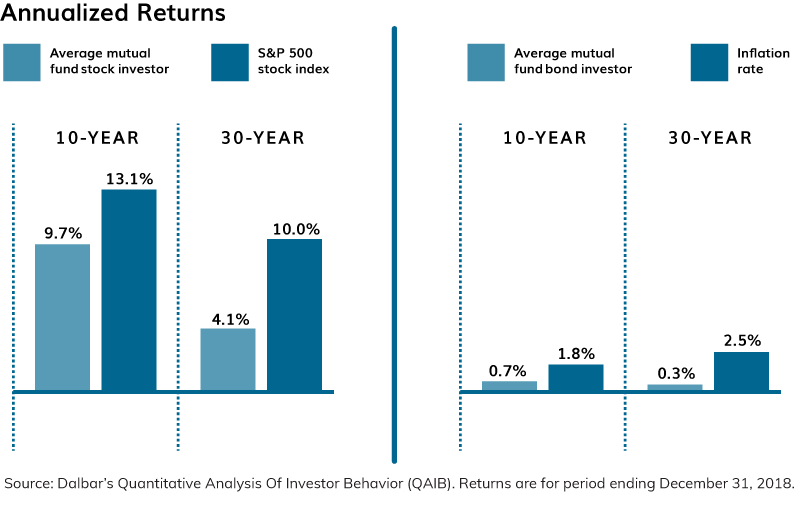

To this end, we execute our asset allocation plans using exclusively passive investments (index funds) because we are unaware of any credible evidence which proves that the selection of individual securities or attempts to time the market do anything but add risk and cost, while reliably reducing returns.

Furthermore, we help you understand the evidence behind it, so that you are more confident in the decisions we make together to best safeguard your financial future.