Investment Strategy

Decades of financial research and data has supported the outperformance of index investing strategies, especially over the long-term.

Index Investing

Index investing was first made broadly available to U.S. investors with the launch of the first index mutual fund in 1976. Since then, low-cost index investing has proven to be an effective investment strategy over the long term, outperforming the majority of active managers across markets and asset styles.

In part because of this long-term outperformance, index investing has seen exponential growth among investors, particularly in the United States, and especially since the global financial crisis of 2007–2009. In recent years, governmental regulatory changes, the introduction of indexed ETFs, and a growing awareness of the benefits of low-cost investing in multiple world markets have made index investing a global trend.

At Patrimonio, we build our portfolios using index funds from the world’s industry leading asset managers (Vanguard, iShares, Schwab) to create a cost-effective asset allocation model best suited for your goals.

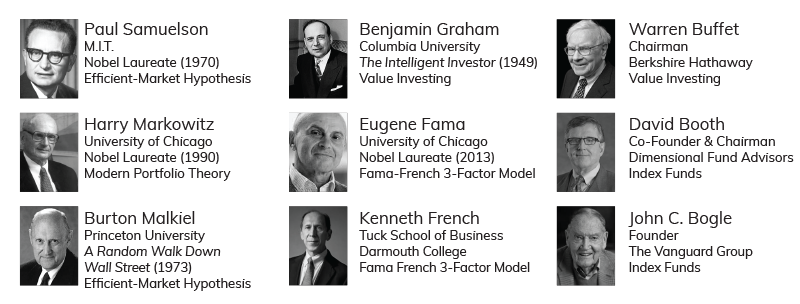

Who Shares Our Opinion?

Decades of financial research and data has supported the outperformance of index investing strategies, especially over the long-term.